Go paper-free

Amend paper-free preferences for your statements and correspondence.

Step into the new tax year with an ISA that helps you save tax efficiently and bring your goals closer.

Discover our ISAs

Earn big when you switch your current account, save and invest with Lloyds.

Terms and conditions apply.

Looking for help? Use the information and guides from our help and guidance hub to find what you need.

We all have dreams, whether they are big or small. Whatever yours might be, when you're ready to take that first step, we're ready when you are.

Based on 21.3 million digital app users (October 2025) across our family of brands (Lloyds, Halifax, Bank of Scotland and MBNA), compared to annual results reported by other UK banking groups between 2024 and 2025.

It's simple and safe in our app or on our website.

Published February 2026

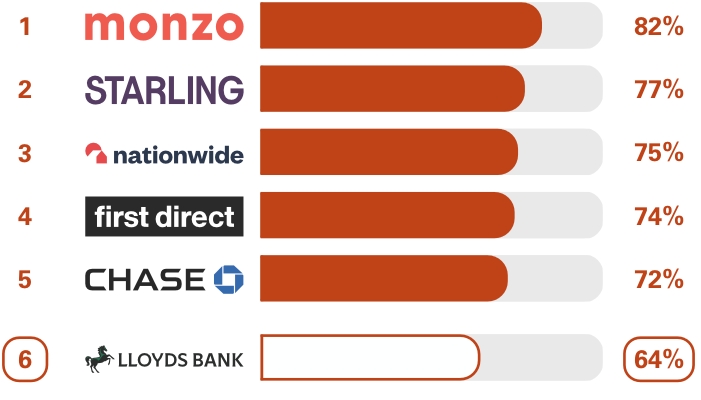

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,000 customers of each of the 17 largest personal current account providers if they would recommend their provider to friends and family. The results represent the view of customers who took part in the survey.

We asked customers how likely they would be to recommend their personal current account provider to friends and family.

The requirement to publish the Financial Conduct Authority Service Quality Information for personal current accounts can be found on the Lloyds Service Quality Information page.

Authorised push payment (APP) scams happen when someone is tricked into transferring money to a fraudster’s bank account. Information about Lloyds’ performance prior to the introduction of the reimbursement requirement in October 2024 can be found in PSR’s latest APP Scams Performance Report (PDF, 1.13MB) published in February 2026.