Download our app

You can pay in cheques, transfer money, and do much more, all from your mobile.

Launching a start-up or considering switching banks? Join the one million UK businesses that already bank with us.

You're covered by the Current Account Switch Guarantee. We’ll switch everything over within seven working days of your account opening. If you decide to switch later, get in touch when you're ready and we’ll guide you through the steps.

Sylwia Golebiowska CEO, Simply GrowWe were attracted to Lloyds for our business banking needs due to their strong reputation, wide range of business services, and the perceived stability and trust that comes with a well-established high street bank.

Steve Athwall CEO/Founder, The Big Phone StoreWith Lloyds, we know our money is in safe hands, and we have someone who understands our business and is always ready to support us, it gives us confidence to keep moving forward.

Find the best bank account for your needs.

Find out more about our Business Account fees and charges.

|

Payment type |

Charges |

|---|---|

|

Payment type Introductory offer |

Charges No monthly account fee for 12 months if it’s your first business account with us |

|

Payment type Monthly account fee |

Charges £8.50 after 12 months |

|

Payment type Electronic payments in2 |

Charges Free |

|

Payment type Electronic payments out2 |

Charges First 100 a month are free / £0.20 each after that |

|

Payment type Cash payments (in or out) |

Charges £0.85 for every £100 at an Immediate Deposit Machine / £1.50 for every £100 over the counter |

|

Payment type Cheques (in or out, any amount) |

Charges £0.85 at an Immediate Deposit Machine / £1 over the counter |

|

Payment type Credit paid in at branch or ATM |

Charges £0.85 |

|

Payment type Credit paid in at an Immediate Deposit Machine, Automated Deposit Machine, through the app |

Charges Free |

|

Payment type BACS |

Charges File submission: £5.50 BACS Item: £0.15 (a set up fee may apply) |

|

Payment type CHAPS |

Charges £30 |

|

Payment type Sending and receiving money abroad |

Charges |

|

Payment type Balances below £0 (going overdrawn) |

Charges |

|

Payment type Other account services |

Charges |

No credit interest is payable on this account.

See the full account rates and charges (PDF, 666KB) and product terms and conditions.

Estimate with our calculator how much your business account could cost per month after the first year.

To open your business account, you’ll need:

If you run a small business, there are various benefits to having a business bank account with Lloyds Bank:

If you’ve already started an online application, you can continue or check the status of your application at any time using the log on button in your welcome email, which you’ll get once you’ve provided your personal details.

Yes, you can easily switch your current business account to a Lloyds Bank business account using the Current Account Switching Service. Once you’ve given us your details, you can sit back and we’ll manage the rest for you. Find out more about switching bank accounts.

In-branch cash and deposit machines, for notes and cheques. Limits and charges will apply.

Other options:

We work with LINK to carry out assessments of places which might need better cash access services.

Concerned about access to cash in your area?

Link may have already looked at your area and made a recommendation to make things better.

If not, you can request an access to cash assessment in your area.

Want to know how decisions are made about cash?

Find out more about LINK’s process.

The Current Account Switch Service lets you switch your current account from one bank or building society to another in just seven working days. It's simple, reliable, and stress-free. We move everything over to your new account, redirect any payments sent to the old account, and make sure your old account is closed.

The Current Account Switch Service is a fast and simple way to switch your Business Account to us.

Before using the service, check it’s right for you. Your business must:

You’ll also need to check that your existing bank is signed up to the service. Over 50 banks and building societies take part in the Current Account Switch Service - view the full list here.

Got a different question? Check the Current Account Switch Service FAQ page.

You can apply for an account in minutes. On-the-go? Download the app and apply from anywhere in the UK. Discover our mobile app.

Or you can apply using the website. Apply online now.

To open your business bank account, you’ll need a few documents to hand. You’ll need:

If you’re applying for an account for a limited company bank account, Companies House must be up to date before we can progress your application. Please allow four days from the date of your Companies House registration before applying to open a business bank account.

You can open a Business Account with us if you’re a sole trader or the director of a limited company.

We have other types of accounts for schools and for charities and community organisations.

Read more and check if your business can apply.

Published August 2025

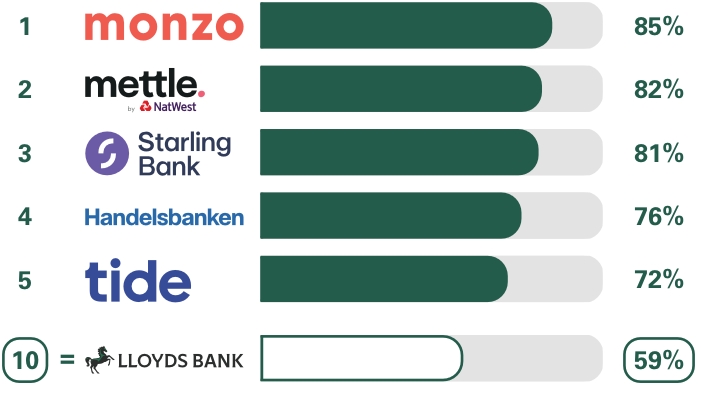

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 17 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here