Switch your business bank account

Switch your business bank account and access the support and services your business needs.

Switching to us is easy

The Current Account Switch Service makes switching current accounts from one UK bank or building society to another simple, reliable and stress-free. It is available to consumers, small businesses, charities and trusts and allows you to choose a switch date that suits you.

Simple ongoing fees and transaction charges

Find out more about our Business Account fees and charges.

|

Payment type |

Charges |

|---|---|

|

Payment type Introductory offer |

Charges No monthly account fee for 12 months if it’s your first business account with us |

|

Payment type Monthly account fee |

Charges £8.50 after 12 months |

|

Payment type Electronic payments in2 |

Charges Free |

|

Payment type Electronic payments out2 |

Charges First 100 a month are free / £0.20 each after that |

|

Payment type Cash payments (in or out) |

Charges £0.85 for every £100 at an Immediate Deposit Machine / £1.50 for every £100 over the counter |

|

Payment type Cheques (in or out, any amount) |

Charges £0.85 at an Immediate Deposit Machine / £1 over the counter |

|

Payment type Credit paid in at branch or ATM |

Charges £0.85 |

|

Payment type Credit paid in at an Immediate Deposit Machine, Automated Deposit Machine, through the app |

Charges Free |

|

Payment type BACS |

Charges File submission: £5.50 BACS Item: £0.15 (a set up fee may apply) |

|

Payment type CHAPS |

Charges £30 |

|

Payment type Sending and receiving money abroad |

Charges |

|

Payment type Balances below £0 (going overdrawn) |

Charges |

|

Payment type Other account services |

Charges |

No credit interest is payable on this account.

See the full account rates and charges (PDF, 232KB) and product terms and conditions.

Estimate with our calculator how much your business account could cost per month after the first year.

Frequently asked questions

-

Once you contact us your business bank account will switch within seven working days from when your new account is opened under the Current Account Switch Service guarantee.

-

No, you won’t need to close your old bank account yourself. Your old bank will close your account as part of the Current Account Switch Service process. All you need to do is fill in the instruction form to authorise the closure.

-

Making the switch to a business bank account with Lloyds Bank, or any other bank using by the Current Account Switch Service, is straightforward. It’s an easy process designed to make changing banks and transferring important information stress-free. Sit back and wait until your switch date and we’ll take care of the rest.

-

The Current Account Switch Service is a fast and simple way to switch your Business Account to us.

Before using the service, check it’s right for you. Your business must:

- have an annual turnover below £6.5 million

- employ fewer than 50 people.

You’ll also need to check that your existing bank is signed up to the service. Over 50 banks and building societies take part in the Current Account Switch Service - view the full list here.

Got a different question? Check the Current Account Switch Service FAQ page.

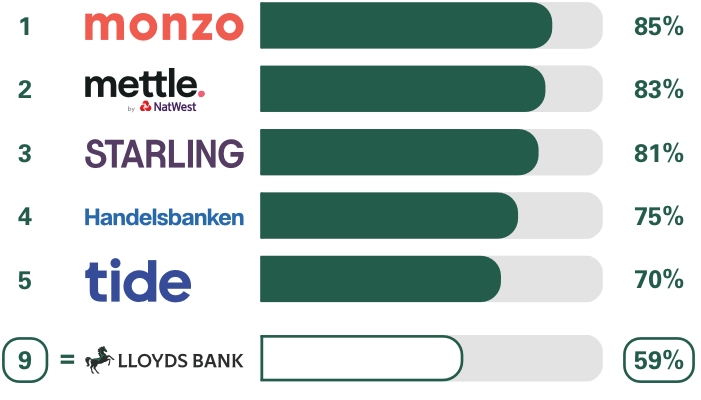

Independent service quality survey results

Business current accounts

Published February 2026

As part of a regulatory requirement, an independent survey was conducted to ask approximately 1,200 customers of each of the 17 largest business current account providers if they would recommend their provider to other small and medium-sized enterprises (SMEs*). The results represent the view of customers who took part in the survey.

Overall service quality

We asked customers how likely they would be to recommend their business current account provider to other SMEs.

*SMEs include businesses, clubs, charities and societies with an annual turnover/income of up to £25m (exclusive of VAT and other turnover-related taxes).

Ranking

The requirement to publish the Financial Conduct Authority Service Quality Information for business current accounts can be found here