Go paper-free

Amend paper-free preferences for your statements and correspondence.

Explore our range of budgeting tips and tools. These could give you a clearer view of your essential bills and other spending.

Managing your money well today, could make things more comfortable tomorrow, so don’t wait to get started.

Setting up accounts for different purposes could help you see how much money you have left over after bills. You could have one account for household bills and another for everyday spending. We know that managing bills can be stressful, but with some tips and tools, we can help you gain control of your payments.

Get a full overview of your income and spending to help you manage your money better. Fill out details of payments received, the savings you hold, and any amounts going out to build a clearer picture of your finances.

Large costs can be difficult to pay in one go. It might be better to see if you can spread the cost with regular, smaller payments instead. See if you can pay monthly by Direct Debit for things like car insurance, or your TV licence fee, which can make them easier to manage.

Whether you're new to saving or looking for easier ways to save, we can help. We’ve got some helpful saving hints and tips to help you reach your goals, reduce spending and develop some new saving habits along the way.

Assist your budgeting by using the MoneySavingExpert income tax calculator. Find out how much income you keep and how much tax you pay.

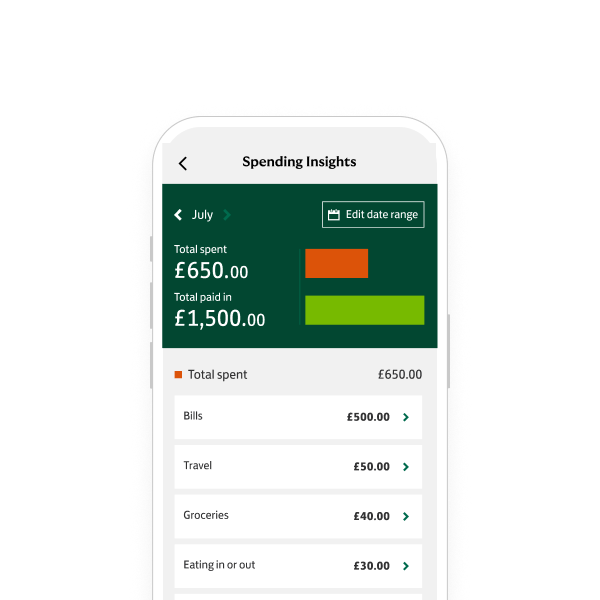

Understanding where your money goes is an important part of budgeting. We have lots of tools available in Internet Banking or on our Mobile banking app that can help you. The following shows how you can access these tools and stay in control of your money.

See a breakdown of where your money goes every month. View your current account spending in categories so you can spot the patterns and see where you might be able to make some savings.