Go paper-free

Amend paper-free preferences for your statements and correspondence.

Most people in the UK would like to retire early.1 Whether you want more time to travel, see loved ones or enjoy hobbies, early retirement is appealing because of the freedom that comes with it and investing could help you get there quicker.

If you want to retire early before you get the state pension, you’ll need enough to pay yourself an income and top up the state pension further down the line.

Investing can help you grow and protect your money from inflation as you get older and closer to retirement. There are many types of investments to suit your risk tolerance but only a fifth of people in their mid-50s+ invest2 – partly due to low awareness.

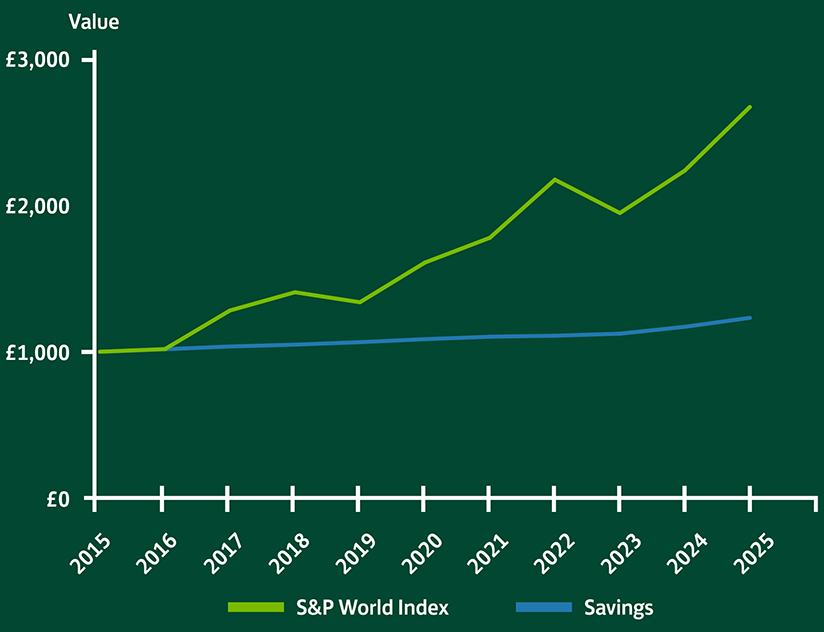

This graph shows a comparison of savings and investments over 10 years.

Source:

(Savings) MoneyFacts, 12m Fixed Non-ISA rates, January 2025.

(Investments) S&P Dow Jones Indices, S&P World Index (GBP). Excludes fees. Past performance is not a reliable indicator of future performance. You can see a breakdown of these figures here.

|

Share Dealing ISA |

Share Dealing Account |

Pension |

|

|---|---|---|---|

|

Share Dealing ISA Main benefit |

Share Dealing Account Tax-efficient growth and withdrawals |

Pension No limits on how much can be paid in |

Tax relief on contributions, tax-efficient growth and employer contributions will boost the pot |

|

Share Dealing ISA When it can be accessed |

Share Dealing Account From the age of 18 |

Pension Any age |

From the age of 55 |

|

Share Dealing ISA Maximum you can pay in each tax year |

Share Dealing Account £20,000 (Reviewed annually) |

Pension No limits |

£60,000 or 100% of earnings |

|

Share Dealing ISA Tax treatment on contributions |

Share Dealing Account No tax relief on payments in, but tax efficient growth once invested |

Pension No tax relief on payments in |

Comes out of pre-tax income, benefiting from tax relief |

|

Share Dealing ISA Tax treatment on withdrawal |

Share Dealing Account Withdrawals are free from UK income tax, dividend tax and capital gains tax |

Pension Withdrawals may be subject to income tax, dividend tax, and capital gains tax declared through an annual HMRC tax return |

The first 25% is tax-free. |

|

Share Dealing ISA Inheritance tax |

Share Dealing Account Potentially liable for inheritance tax |

Pension Potentially liable for inheritance tax |

Currently free of inheritance tax. Potentially liable from April 2027 |

Not all investing is equal, as there are different risk levels.

If you’re saving for the future - perhaps 7 to 10 years plus - you might be more comfortable taking more risk. There’s longer to ride out any fluctuations and for your money to recover from stock market turbulence.

A higher amount of risk normally means putting your money in company shares (stocks).

When you invest in shares, you essentially own a small part of that company and could benefit from any growth in value or profits. But companies can also fail, so your money could drop.

You don’t have to invest in individual companies directly. Instead, you could invest through a fund. This way, you could invest in potentially hundreds of companies which reduces risk because they are unlikely to all fail.

Investment bonds are issued by organisations wanting to borrow money, while gilts are issued by the government. You buy these bonds, essentially providing the loan, and receive interest and your money back when the loan period ends. Bonds or gilts offer the potential for more stable returns, but lower potential gains than stocks.

You may want to choose both stocks and bonds if you like the idea of more stable returns now – but also want to invest for the best chance of long-term growth.

The reality is you’re likely to want a combination of investments for your life savings. Being diversified means you’re spreading risk. If you don’t want to choose your own, consider a ready-made fund that incorporates all types of investments. Our Ready-Made Investments are curated by experts to create a portfolio suited to the risk you feel comfortable taking. They don’t require any investing experience, leaving the hard work to the experts.

You can book a free session with one of our Financial Coaches about the different investment options we offer. Or if you’d like specialist financial advice such as which investments are likely to be most suitable for you, our partners at Schroders Personal Wealth can offer a no-obligation initial free chat. Fees and charges will apply if you take out a product or service.

You may be at a stage in life where you’ve paid off the mortgage, are no longer subsidising children or have lower financial commitments in general.

By investing and taking advantage of tax-efficient accounts, you have a stronger chance of growing your savings and overall wealth for the future.

Important information – This article isn’t personal advice. If you’d like to discuss any of the topics covered here, including the actions for your individual circumstances, please contact your financial adviser. If you do not have a financial adviser, you may be able to access one through our partnership with Schroders Personal Wealth (fees and eligibility criteria apply). You can find a local adviser based on your requirements on the Unbiased website. You can also find mortgage brokers, accountants, and solicitors on Unbiased.

The contents of this page are accurate as of 11 February 2025. Our views and references to pensions, tax, investment, or their rules, may have changed since then.

Past performance is not a reliable indicator of future performance. Please remember that the value of investments and the income from them can fall as well as rise, and you may get back less than you invest. If you’re not sure about investing, seek financial advice. There will normally be a charge for that advice.

Tax treatment depends on individual circumstances and may be subject to change in the future.

1 Source: Scottish Widows Retirement report 2024, (PDF 4.2MB)

2 Source: www.gov.uk/government/statistics/family-resources-survey-financial-year-2022-to-2023