Go paper-free

Amend paper-free preferences for your statements and correspondence.

Pensions can be confusing, but we can provide clear insights and explain the benefits having one could bring to your future.

That came round quickly, didn't it? Whether you’re close to retirement or already have the financial freedom to embrace the good life, now’s the time to look around and ask what’s next.

Perhaps a bucket list trip. Maybe you fancy a little side hustle, plan to launch a business or sign up for the Great British Bake Off. It's your moment to explore what really tickles your taste buds.

Your goal now is to make sure your nest egg stretches as far as possible into the future to pay for your new lifestyle, whatever that means for you.

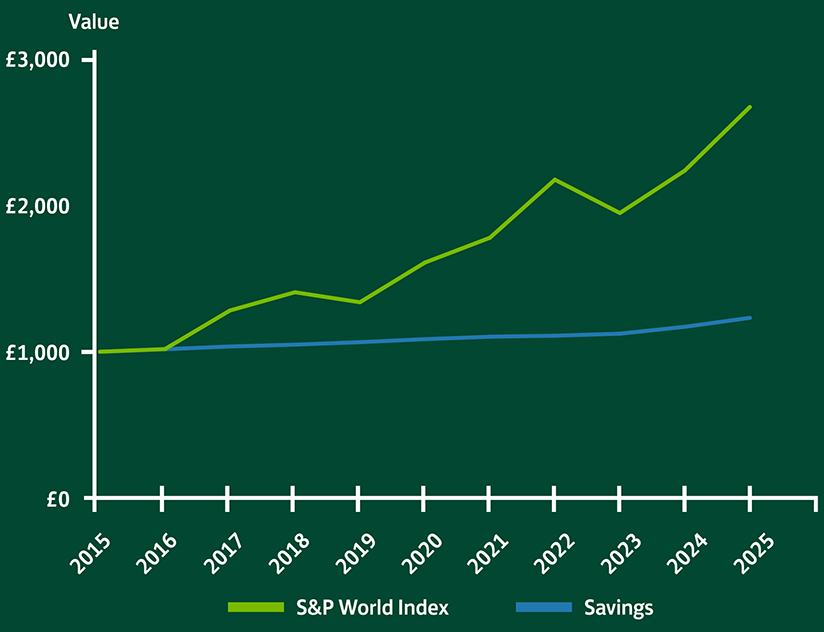

This graph shows a comparison of savings and investments over 10 years.

If you’d invested £1,000 in a fund tracking the S&P World Index (it tracks medium to large companies across 24 developed markets) in 2015, it would have been worth £2,659 in January 2025. Whereas £1,000 kept in a typical savings account would be worth £1,229 in January 2025.

Source:

(Savings) MoneyFacts, 12m Fixed Non-ISA rates, January 2025.

(Investments) S&P Dow Jones Indices, S&P World Index (GBP). Excludes fees. Past performance is not a reliable indicator of future performance. You can see a breakdown of these figures here.

You might consider using your pension pot to buy an annuity which gives you a regular guaranteed payment for life and could even cover a spouse too.

Certainty is tempting. But if you take an annuity, you can’t leave your pension to your children after you pass away.

Pro tip: Perhaps consider a mix of both – buy an annuity and keep your own personal pot to dip into when needed.

For financial advice, our Schroders Personal Wealth team is ready to walk you through your choices. Book a free initial consultation today to see if they can help.

Fees and charges will apply if you take out a product or service.

One concern for many people aged 65+ is to help their children and grandchildren financially. Yet one fifth say they don’t have anything in place to provide an income to their dependants after passing away, a 2024 Scottish Widows retirement report (PDF, 4.3MB) has found.

The most important starting point is the end point. Your will. Is yours properly drafted and up to date?

You may need to revise it several times, the older you get – and if your circumstances change, for example you divorce or you marry. Power of Attorney is a good thing to think about here too, so your affairs are always in hand.

So ultimately, it’s all about living well now, and designing your legacy just as you like. Protecting and growing your money during your retirement, while being confident you can live the life you want and can help others if you wish.

Important information – This article isn’t personal advice. If you’d like to discuss any of the topics covered here, including the actions for your individual circumstances, please contact your financial adviser. If you do not have a financial adviser, you may be able to access one through our partnership with Schroders Personal Wealth (fees and eligibility criteria apply). Unbiased is a service that finds a local adviser based on your requirements. You can also find mortgage brokers, accountants, and solicitors on Unbiased.

The contents of this page are accurate as of 10/01/2025. Our views and references to pensions, tax, investment, or their rules, may have changed since then.