Grow your savings, on your terms

Compare our business savings accounts

1.31% - 2.05% AER¹

-

Lock money away for an agreed term.

-

Get a fixed rate of interest for the length of your term.

-

Deposit at least £10,000 and up to £5 million.

-

Earn 1.30% - 2.04% Gross p.a.²

1.87% - 2.66% AER¹

-

Choose a 32 or 95-day notice period to withdraw money.

-

Get a variable rate of interest set by Lloyds Bank.

-

Deposit at least £10,000 and up to £5 million.

-

Earn 1.85% - 2.63% Gross p.a.²

0.60% - 1.41% AER¹

-

Access your money anytime you need it.

-

Get a variable rate of interest set by Lloyds Bank.

-

Start small and grow your savings alongside your business.

-

Earn 0.60% - 1.40% Gross p.a.²

Interest rates stated above for fixed term deposits and notice accounts are available as at 19/12/2025 and expire on 05/02/2026 and may be subject to change.

1 AER – The AER stands for Annual Equivalent Rate and is the notional rate, which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER, you’ll be able to compare more easily what return you can expect from your savings over time.

2 Gross Rate – Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

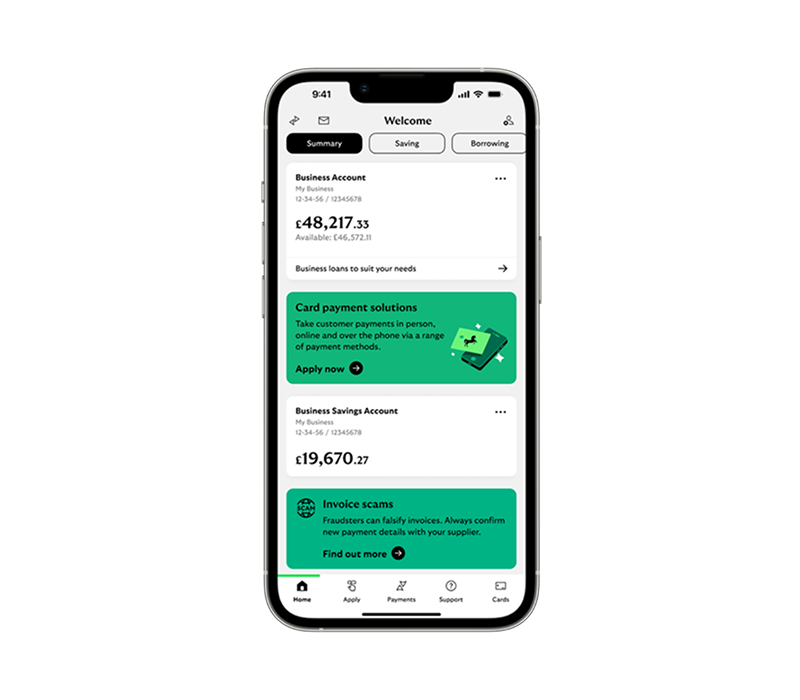

Apply on our Business Banking Mobile App

Log on to the Business Banking Mobile app to apply for an Instant Access Account, Fixed Term Deposit, or a Notice Account.

-

For instant access accounts please call 0800 056 0056.

For fixed term deposits or notice accounts call us on 0345 305 5555.

-

Interest Rates

Fixed Term Deposit Account

These interest rates apply to Sterling deposits only with a minimum balance of £10,000 and maximum balance of £5m.

AER1

Gross p.a.2

Term length

AER1

1.31%

Gross p.a.2

1.30%

Term length

3 months

AER1

2.05%

Gross p.a.2

2.04%

Term length

6 months

AER1

2.05%

Gross p.a.2

2.04%

Term length

9 months

AER1

2.04%

Gross p.a.2

2.04%

Term length

12 months

AER1

2.05%

Gross p.a.2

2.04%

Term length

Fixed until 16/07/2026

AER1

2.04%

Gross p.a.2

2.04%

Term length

Fixed until 17/03/2027

Interest rates stated above are available as at 19/12/2025 and expire on 05/02/2026 but may be subject to change. Once you open your deposit account, the interest rate is fixed, so will stay the same throughout your chosen term.

Interest is calculated as follows: Interest rate multiplied by the number of days of the fixed term divided by 365 days then multiplied by the initial deposit amount. For example, a £10,000 deposit for 3 months at a 1.30% interest rate would be calculated as follows: 1.30% x (91/365) x £10,000.

Interest is paid at the end of the agreed term.

We only offer standard terms online for Fixed Term Deposit Accounts. If you would like to apply for bespoke term lengths or you need to select specific start and end dates for your deposit, call us on 0345 600 6391. We are available 8am to 5pm Monday to Friday.

Notice Accounts

The interest rates shown in the table are variable.

These interest rates apply to Sterling deposits only with a minimum balance of £10,000 and maximum balance of £5m. Interest is calculated and paid to your account daily (unless otherwise agreed). The interest rate is set and managed by Lloyds Bank.

AER1

GROSS p.a.2

Notice period

AER1

1.87%

GROSS p.a.2

1.85%

Notice period

32 days’ notice required to make withdrawal or close the account

AER1

2.66%

GROSS p.a.2

2.63%

Notice period

95 days’ notice required to make a withdrawal or close the account

Interest rates stated above are available as at 19/12/2025 and expire on 05/02/2026 but may be subject to change.

Instant Access Account

The interest rates shown in the table are variable.

Current interest rates

Business instant access account Interest paid monthly

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

Interest paid monthly

£20,000,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

1.41%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

1.40%

Interest paid monthly

£10,000,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

1.31%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

1.30%

Interest paid monthly

£1,000,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

1.06%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

1.05%

Interest paid monthly

£500,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

0.80%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

0.80%

Interest paid monthly

£100,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

0.70%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

0.70%

Interest paid monthly

£1+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

0.60%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

0.60%

These interest rates are correct as at 09 September 2025. Interest is calculated daily and paid monthly.

Interest rates with effect from 20 January 2026

Please note that with effect from 20 January 2026, the rates of credit interest and interest tiers for this product will change to those shown below:

Business instant access account Interest paid monthly

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

Interest paid monthly

£20,000,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

1.21%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

1.20%

Interest paid monthly

£10,000,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

1.11%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

1.10%

Interest paid monthly

£1,000,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

0.90%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

0.90%

Interest paid monthly

£500,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

0.70%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

0.70%

Interest paid monthly

£100,000+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

0.60%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

0.60%

Interest paid monthly

£1+

AER (%)The AER stands for Annual Equivalent Rate and is the notional rate which illustrates the gross rate as if paid and compounded on an annual basis. As every advert for a savings product will contain an AER you will be able to compare more easily what return you can expect from your savings over time.

0.50%

Gross (%)Gross rate means that no tax will be automatically deducted from interest on your behalf. You are responsible for paying any tax due to HM Revenue and Customs.

0.50%

These interest rates will apply from 20 January 2026. Interest is calculated daily and paid monthly.

-

Fixed Term Deposit Accounts

For customers with an annual turnover of £0-25m

Fixed Term Deposit product information factsheet (PDF, 148 KB)

32 Day Notice Account

- 32 days’ notice is required to close the account.

- Funds are committed for a minimum period of 32 days.

- The interest rate is a managed rate set by Lloyds Bank and is subject to change.

- Minimum withdrawal amount £10,000.

- Minimum balance £10,000.

For clients with an annual turnover of £0-25m

32 Day Notice account product information factsheet (PDF, 376 KB)

95 Day Notice Account

- 95 days’ notice is required to close the account.

- Funds are committed for a minimum period of 95 days.

- The interest rate is a managed rate set by Lloyds Bank and is subject to change.

- Minimum withdrawal amount £10,000.

- Minimum balance £10,000.

For clients with an annual turnover of £3m-£25m

95 Day Notice account product information factsheet (PDF, 384 KB)

Fixed Term Deposit and Notice Account Terms and Conditions

Product Terms for Deposit Accounts (PDF, 397 KB)

Instant Access Account