Change your business address

If you're a full access user, you can update your business, registered, mailing and personal addresses within Online for Business and the Business banking app.

Ideal if you're aiming for a way to spread costs over the longer-term with flexible repayment options.

Looking to pay in full each month? Pick a Charge Card and you'll know exactly what to repay.

Turnover more than £3 million? Discover our range of physical and virtual payment solutions and streamline your reporting with integration to your existing accounting software.

You can earn 1% cashback on fuel and electric vehicle charging and 0.5% on other purchases.

Minimum spend threshold of £2,000 applies**

This calculator provides an illustration only.

Any cashback earned is credited to your business card account monthly.

Cashback is calculated on all qualifying transactions across your total Business Credit or Charge Card account for each monthly billing cycle, subject to achieving a minimum spend threshold of at least £2,000 in that billing cycle.**

Get support to manage your Business Credit Card or Business Charge Card - whether you want to order a new card, view or replace your PIN.

Keep up with business outgoings by viewing your statements and recent transactions online.

You can now compare our currency conversion charges for card transactions in euro and other EEA currencies. We display these charges as a percentage mark up over the European Central Bank reference rate (ECB rate). The table below does not take into account any other transaction costs we charge, for example foreign currency cash fees.

|

|

|

|---|---|

|

Your Credit Card foreign currency transaction fee mark up over the ECB rate. |

##euromarkup##% |

Exchange rates

The table should be used as a guide only. Rates are updated once a day on business days. We use Mastercard rates and ECB rates which are subject to change.

Transactions in EEA currencies other than euro will be converted to euro first, then pounds sterling.

You can find the latest available Mastercard exchange rate here.

Fees for currency conversion

The comparison above uses the credit card standard non-sterling transaction fee of 2.95%.

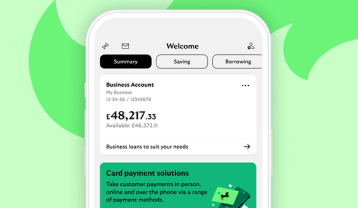

Current customers can log in and apply through Online for Business.

You can see a full list of fees and charges on our Credit Card and Charge Card pages.

You can use your Credit and Charge Cards in any location in the world that accepts Mastercard® payments. Note that non-sterling payments may be subject to fees and conversion rates.

Yes, you benefit from up to 1% cash back on purchases, minimum spend threshold applies, as well as merchant rebates with Business Savings by Mastercard® - you’ll also enjoy added protection with Buyers Protection Insurance** and Travel Insurance**.

Yes, you can view your Lloyds Bank Business Credit and Charge Cards online through Online for Business.

If you are registered as a full access user with Online for Business, you can make changes to your Business Representatives and cardholders online.

Whether you're an established business or just starting out, finding the right finance product can be difficult.

Compare and choose our products, whatever the business needs.

The right type of funding can play a vital role in helping your business reach its potential. If your lending application is declined, we will work with the British Bankers’ Association to pursue any raised appeals.

*Up to 56 days of interest-free on credit card purchases and up to 42 days of interest-free on charge card purchases, but there may be other charges and fees for non-sterling purchases. Fees and interest apply to cash withdrawals.

**Cashback is calculated on all qualifying transactions across your total Business Credit or Charge Card account for each monthly billing cycle, subject to achieving a minimum spend threshold of at least £2,000 in that billing cycle. This minimum spend threshold of £2,000 applies per Business Credit or Charge Card account you hold with us. Cashback doesn’t apply to cash withdrawals, balance transfers, money transfers, cryptocurrency or gambling transactions.

***To provide you with Buyers Protection Insurance and Travel Insurance, Lloyds Bank works with Aspire Insurance Advisers, who administer the policy on behalf of Certain Underwriters at Lloyd’s of London.

Cashpoint® is a registered trademark of Lloyds Bank plc.

Mastercard® is a registered trademark.