Change your business address

If you're a full access user, you can update your business, registered, mailing and personal addresses within Online for Business and the Business banking app.

Giving you control of your finances so that you can focus on what matters.

You must be registered for Online for Business or Commercial Banking Online. UK based businesses only.

Business Finance Assistant allows you to send professional-looking invoices, track when you’ve been paid and send reminders to customers.

You’ll also be able to provide access to your accountant and create multiple users for your business – helping you to manage your finances.

Business Finance Assistant can help you:

Your transactions can also be automatically categorised and reconciled, saving you time when managing your accounts.

View and manage your expenses all in one place.

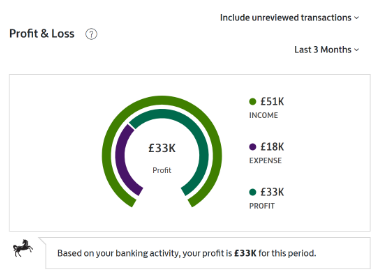

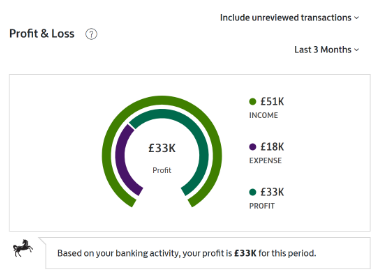

Track your business’ performance using a customisable dashboard.

Submit your VAT returns via Business Finance Assistant.

Yes. We’ve designed it in a way which is simple and intuitive. Business Finance Assistant offers similar features as our competitors for free. Our support model includes a virtual helpdesk to answer your queries, in addition to our knowledge hub which includes videos that show you exactly how to use your accounting software.

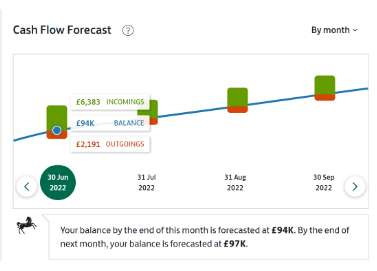

You can use features such as our cash flow forecasting tool to drill down into time periods that are most relevant to your business. You can also invite your accountant and other people involved in your business to access Business Finance Assistant to help you manage your accounts.

Business Finance Assistant is used by businesses of all types and sizes. Businesses who regularly invoice clients have found Business Finance Assistant helps them to save time and ensures they also produce professional-looking invoices. We also know it’s easy to lose track of who hasn’t paid so our invoice features easily show you who has unpaid and gives you the option to remind them via a simple email.

Making Tax Digital is a requirement from HMRC for businesses to submit their VAT returns digitally. Business Finance Assistant is listed on the HMRC Making Tax Digital compliance list and can help you create and send digital tax returns to HMRC directly.

You can cancel anytime from within your Business Finance Assistant account:

The Government requires digital submissions for tax information. Understand how Making Tax Digital impacts you.