Change your business address

If you're a full access user, you can update your business, registered, mailing and personal addresses within Online for Business and the Business banking app.

Help and support

Supporting your banking needs

If you're a full access user, you can update your business, registered, mailing and personal addresses within Online for Business and the Business banking app.

Online banking

Our online services

You can pay in cheques, transfer money, and do much more, all from your mobile.

Accounts and savings

Everyday banking and payments

Find out more

Open a Business Account in March and get £200. How’s that for a helping hand?

Borrowing

Loans, cards and finance

Find out more

No arrangement fee if you apply online for Asset Finance before July 2026.

Take payments

Card readers and online

Existing customers

Accept card payments with our wide range of face-to-face solutions.

International trade

Business at home and abroad

Existing customers

Insurance

Find the right cover

Find out more

Help protect your business from legal fees and compensation costs if a customer, client or other third party makes a claim against you.

Insights and resources

Sector, start-up, run and grow

Practical resources, tailored guidance and support designed to help women founders thrive.

Corporate solutions

For corporates & institutions

Useful resources

Find the latest insights, reports, expert commentary, client case studies, and economic and markets updates.

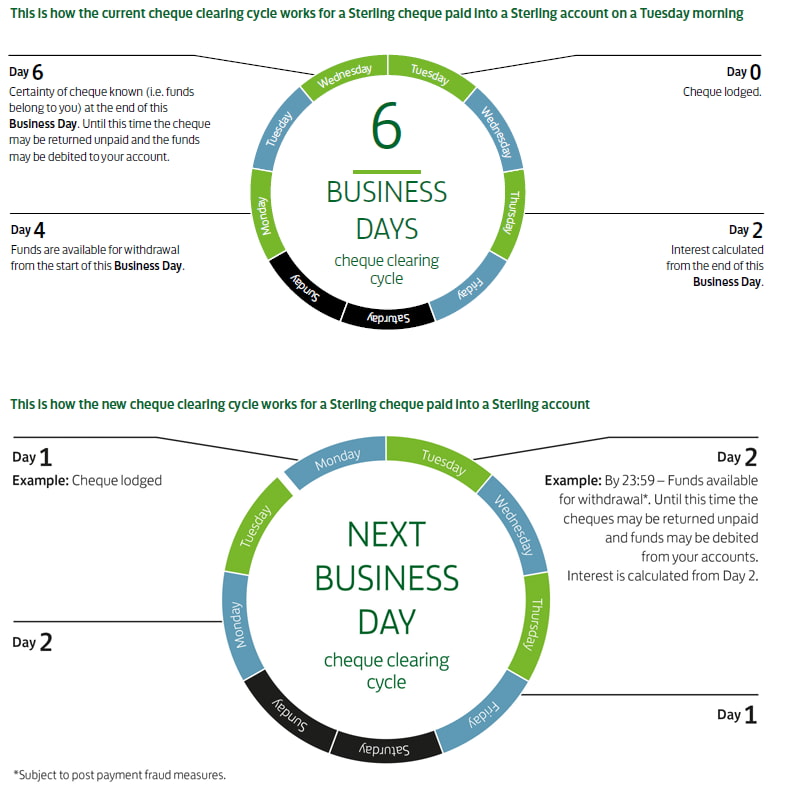

All cheques written and received by you go through the clearing cycle, a system used by the main British Banks to transfer money between accounts.

The clearing cycle used by the main banks changed in November 2007 and is now often referred to as the ‘2-4-6’ process (or ‘2-6-6’ for deposit accounts) as it sets a maximum time limit of two, four or six working days for each stage of the process after paying in a cheque.

This is how it works –

If you pay a cheque in on a Monday morning:

This does mean that a cheque can still be taken from your account for up to six days after you pay it in even if you have already spent it.

For our purposes, a working day lasts from 9.00am to 5.00pm, Monday to Friday, excluding Bank Holidays. Cheques or cash paid in after 5.00pm (sometimes after 3.30pm) won’t be processed until the next working day.

If you have any further questions about the clearing cycle, please contact our business management team or your local branch.

More information on this initiative, and how it applies across the UK Banking industry, is available at www.chequeandcredit.co.uk/246*

*While all reasonable care has been taken to ensure that the information provided is correct, no liability is accepted by Lloyds Bank for any loss or damage caused to any person relying on any statement or omission. This is for information only and should not be relied upon as offering advice for any set of circumstances. Specific advice should always be sought in each instance.

From the 30 October 2017 a new “Next Business Day cheque clearing cycle" will be introduced for all banks in the UK. This will run alongside the existing “6 Business Days cheque clearing cycle”. The clearing cycle used will depend on which bank a cheque is deposited with, and by the method of deposit. From 30 October 2017, until the 6 Business Day clearing cycle is removed, both clearing cycles will be in operation.

You should anticipate money from cheques you write leaving your account on the next Business Day; and money being cleared from cheques you deposit within 6 Business Days. You should always ensure you have sufficient funds in your account prior to issuing a cheque.

More information about how the cheque clearing cycle works across UK banks can be found on the payment scheme website managed by the Cheque and Credit Clearing Company.

These timescales are industry guidelines. Interest calculations and the availability of funds may be earlier in certain circumstances.

Cheques paid in at a branch after 17:00 on a Business Day or any day which is not a Business Day may not begin to be processed until the next Business Day. Some branches have an earlier cut-off than 17:00. A notice will be displayed in such branches which will specify the earlier cut-off time. Cheques paid in via alternate methods than a branch will have different cut-off times. Please refer to the specific T&Cs for that method of deposit for more details.

Timescales for bulk cheque schemes may be different. Please contact your relationship team for further information.

We're committed to helping British businesses grow and develop by giving them the support they need – our Business Charter will tell you more.

Businesses, new and established, will face fresh challenges and opportunities. Our comprehensive range of online business resources and tools are designed to help.

Internet Banking puts you in control of your finances, giving you time to concentrate on what is important - your business.