Go paper-free

Amend paper-free preferences for your statements and correspondence.

An Individual Savings Account (ISA) works like a regular savings or investment account, but with one big advantage: any interest earned is tax efficient.

ISAs, limits, types and tax, each important terms - but we're here to guide you through it. In this guide, you'll discover:

An ISA helps you to save and invest tax efficiently. There are four different kinds of ISA: cash ISAs, stocks and shares ISAs, lifetime ISAs and innovative finance ISAs.

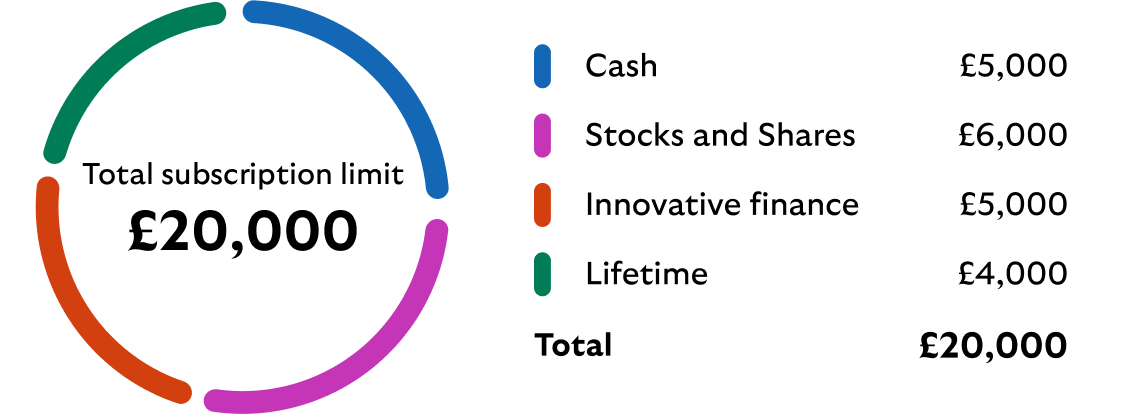

You can subscribe to the four types of ISA in lots of combinations, as long as you do not exceed the annual ISA subscription limit, currently £20,000.

To apply for an ISA, you must be at least 18 and a resident in the UK for tax purposes.

Each tax year (06 April to 05 April of the following year) the Government sets a subscription limit on the amount you can save in an ISA. Currently this subscription limit is £20,000 in total. You can split this across the different types of ISAs. The different types of ISAs have their own limits.

We offer Stocks and Shares and Cash ISAs. You can hold multiple cash ISAs with us, but you can only contribute to one each tax year.

Saving or Investing in an ISA protects your Personal Savings Allowance. Interest and gains earned within an ISA are paid tax-efficiently. Interest and gains from non-ISA accounts, e.g. regular savings accounts, may attract tax.

For instance, if you’re a basic rate taxpayer, you can earn up to £1,000 interest on your savings without paying UK income tax on it. Any interest you earn over and above your Personal Savings Allowance, outside of an ISA, could be subjected to tax.

There are several types of tax that can impact the interest you earn on savings or the returns you make from investing. ISAs can help you save or invest tax efficiently.

If you’d like to find out more information, we have these pages on tax for your savings and tax for your investments.

The tax year ends on 05 April. After this date, many of your annual tax allowances will reset. This includes the amount you can contribute to an Individual Savings Account (ISA). Also, how much you could earn in interest, capital gains or dividends.

An unused ISA allowance does not roll over to the next tax year. If you don’t use it by 05 April, you lose it for that tax year. Any funds added after then count towards the new tax year.

Explore our ISA options and find the right setup for your financial goals.

Find out how your Personal Savings Allowance (PSA) effects the tax you pay on savings and investments.

Find out more about the ISA allowance and how you save money each year.

The Lloyds Bank Direct Investments Service is operated by Halifax Share Dealing Limited. Registered Office: Trinity Road, Halifax, West Yorkshire, HX1 2RG. Registered in England and Wales no. 3195646. Halifax Share Dealing Limited is authorised and regulated by the Financial Conduct Authority under registration number 183332. A Member of the London Stock Exchange and an HM Revenue & Customs Approved ISA Manager.

Lloyds and Lloyds Bank are trading names of Lloyds Bank plc. Registered office: 25 Gresham Street, London EC2V 7HN. Registered in England and Wales No. 2065. Lloyds Bank plc is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority under registration number 119278.