Go paper-free

Amend paper-free preferences for your statements and correspondence.

We'll guide you through it.

If you need more help, use the virtual assistant.

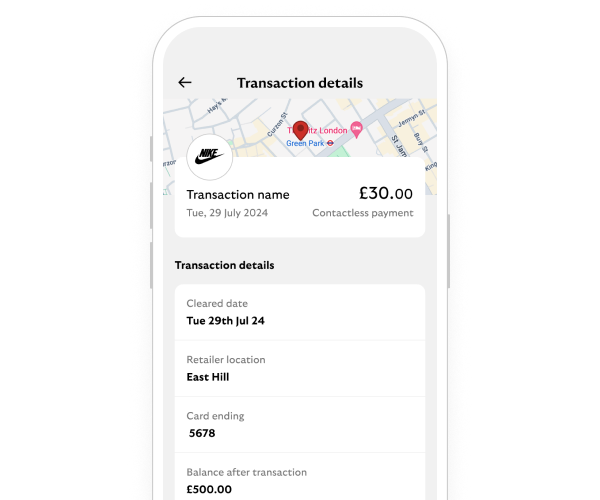

1. Log in to our app and open your list of transactions.

2. Find the transaction you want to dispute and select 'Help with this transaction'.

3. Select 'Help with this transaction' and choose the relevant option.

4. Follow the steps on screen.

If you need more help, use the virtual assistant.

The simplest way to raise a claim is in the app. If you can’t do this online, you'll need to give us a call.

If you have the app, you can skip the security questions by calling us directly from the app. Log in to the app, search 'Call us' and follow the steps on screen.

Because of Section 75, if you’ve bought something with your Lloyds credit card, the business or retailer and Lloyds may be equally responsible if things go wrong.

So, for example, if the item or service is faulty, doesn’t arrive or isn’t as described, you may be able to claim a refund from either the business or retailer or from Lloyds.

Learn more about how Section 75 protects your credit card spending. Then, if you’d like us to take your case a step further, we’ll need a few things from you:

A pending transaction is money set aside for the retailer to collect from your account. They’ll usually take the payment within a few days, but sometimes it can take longer.

If the retailer cancels the transaction, or confirms the transaction has failed, it will automatically be removed from your transactions list. This should happen within a week, and you won’t be charged.

You can't cancel or dispute a pending transaction.

In some cases, we can remove a pending transaction from your account and return the amount within 24 hours. Just keep in mind that the retailer can still take the payment later.

If something doesn’t look right, or you’re worried about a pending transaction, we’re always here to help. Send us a message.

|

Payment code |

Payment type |

|---|---|

|

Payment code BGC |

Payment type Bank Giro Credit |

|

Payment code BNS |

Payment type Bonus BP |

|

Payment code BP |

Payment type Bill Payment |

|

Payment code CHG |

Payment type Charge |

|

Payment code CHQ |

Payment type Cheque |

|

Payment code COM |

Payment type Commission |

|

Payment code COR |

Payment type Correction |

|

Payment code CPT |

Payment type Cashpoint |

|

Payment code CSH |

Payment type Cash |

|

Payment code CSQ |

Payment type Cash/Cheque |

|

Payment code DD |

Payment type Direct Debit |

|

Payment code DEB |

Payment type Debit Card |

|

Payment code DEP |

Payment type Deposit |

|

Payment code EFT |

Payment type EFTPOS (Electronic funds transfer at point of sale) |

|

Payment code EUR |

Payment type Euro Cheque |

|

Payment code FE |

Payment type Foreign Exchange |

|

Payment code FEE |

Payment type Fixed Service Charge |

|

Payment code FPC |

Payment type Faster Payment Charge |

|

Payment code FPI |

Payment type Faster Payment Incoming |

|

Payment code FPO |

Payment type Faster Payment Outgoing |

|

Payment code IB |

Payment type Internet Banking |

|

Payment code INT |

Payment type Interest |

|

Payment code MPI |

Payment type Mobile Payment Incoming |

|

Payment code MPO |

Payment type Mobile Payment Outgoing |

|

Payment code MTG |

Payment type Mortgage |

|

Payment code NS |

Payment type National Savings Dividend |

|

Payment code NSC |

Payment type National Savings Certificates |

|

Payment code OTH |

Payment type Other |

|

Payment code PAY |

Payment type Payment |

|

Payment code PSB |

Payment type Premium Savings Bonds |

|

Payment code PSV |

Payment type Paysave |

|

Payment code SAL |

Payment type Salary |

|

Payment code SPB |

Payment type Cashpoint |

|

Payment code SO |

Payment type Standing Order |

|

Payment code STK |

Payment type Stocks/Shares |

|

Payment code TD |

Payment type Dep Term Dec |

|

Payment code TDG |

Payment type Term Deposit Gross Interest |

|

Payment code TDI |

Payment type Dep Term Inc |

|

Payment code TDN |

Payment type Term Deposit Net Interest |

|

Payment code TFR |

Payment type Transfer |

|

Payment code UT |

Payment type Unit Trust |

|

Payment code SUR |

Payment type Excess Reject |

Need help?

If you're registered for online banking, the fastest way to get in touch is by messaging us securely online.