Go paper-free

Amend paper-free preferences for your statements and correspondence.

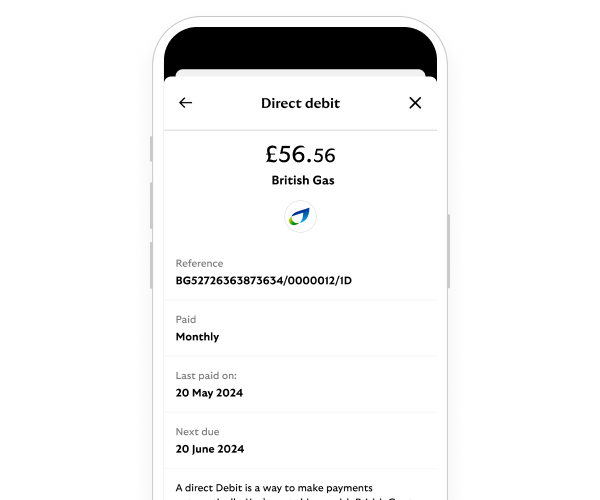

You should always tell the company you’re paying if you cancel a direct debit.

If you cancel a direct debit that’s due in the next two days, it may still leave your account.

We'll guide you through it.

(1 min 18 secs)

You can call us if you're not registered for online banking. If you prefer to bank in person, there’s a range of services in your local area.

Need help?

If you're registered for online banking, the fastest way to get in touch is by messaging us securely online.

|

Regular payment types |

What it is |

Used for things like |

See these guides |

|---|---|---|---|

|

Regular payment types Direct debit |

What it is

|

Used for things like

|

See these guides |

|

Regular payment types Standing order |

What it is

|

Used for things like

|

See these guides |

|

Regular payment types Subscription payment |

What it is

|

Used for things like

|

See these guides View, cancel or block a subscription (app only) |