Go paper-free

Amend paper-free preferences for your statements and correspondence.

Check your policy booklet for general information on your policy, or your policy schedule for details about your personal cover.

It's important to keep your policy up to date. If your circumstances change, you may need to update your policy to make sure you have the right level of cover.

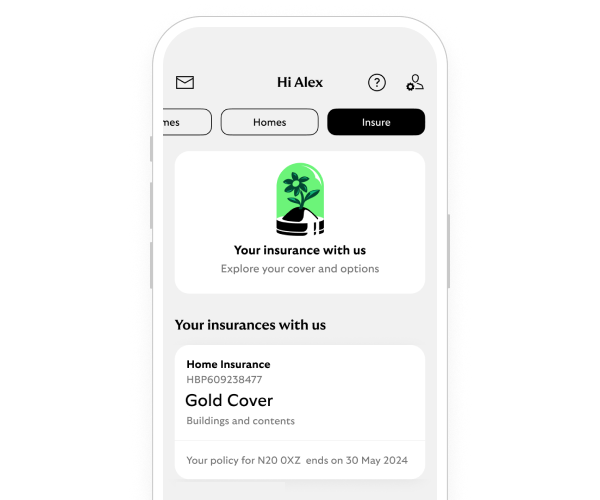

First, you'll need your policy number. Your policy number begins with three letters (such as HBP) and can be found on any home insurance letter we've sent you. If you're registered for online banking, you can log in and find it there.

Select the first three letters of your policy number, or quote reference, from the list. So, if your policy number was HBP123456789, select HBP.