Go paper-free

Amend paper-free preferences for your statements and correspondence.

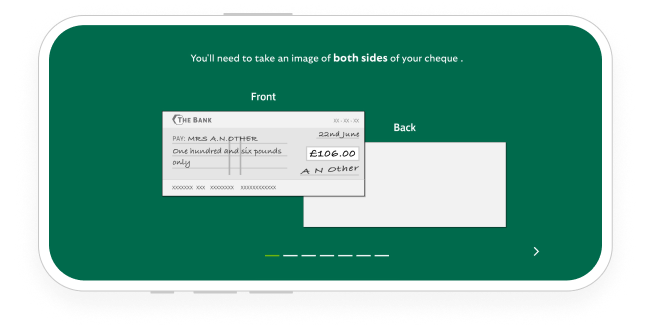

There are some types of cheque that you can't pay in with the app. The app will let you know if this happens.

We'll guide you through it.

(2 min 8 secs)

To see how to do this, watch our video (2 min 8 secs).

If you prefer to bank in person, there’s a range of services in your local area.

You can also pay in a cheque by post.

Make sure the cheque is less than six months old and the recipient name is right.

The amount should be written in both words and numbers and they should match.

The cheque should be in British pounds (£) and pence.

Make sure the cheque is signed.

Write the sort code and account number of the account you want the cheque paying into on the back of the cheque.

You can post your cheque to us in 2 ways. Write your sort code and account number on the back of the cheque, place it in an envelope and choose from the following options.

Once we receive your cheque, the money should reach your account within 2 working days.

Need help?

If you're registered for online banking, the fastest way to get in touch is by messaging us securely online.

|

Cheque clearing process |

When will the payment affect any interest you get or daily arranged overdraft interest you pay? |

When will the payment be available for you to use? |

When can the cheque be returned unpaid? |

|---|---|---|---|

|

Cheque clearing process Cheques paid in using the cheque imaging process |

When will the payment affect any interest you get or daily arranged overdraft interest you pay? By 11.59pm on the working day after we receive the cheque. |

When will the payment be available for you to use? From 11.59pm on the working day after we receive the cheque, at the latest. |

When can the cheque be returned unpaid? Up to 11.59pm on the working day after we receive the cheque. |