Go paper-free

Amend paper-free preferences for your statements and correspondence.

We can help you keep your money safe from fraudsters. If you do everything you can to protect your accounts, we’ll be more likely to refund you if you lose money to a scam.

Authorised Push Payment (APP) fraud is a transfer of funds across Faster Payments, CHAPS or an internal transfer, authorised by a customer where:

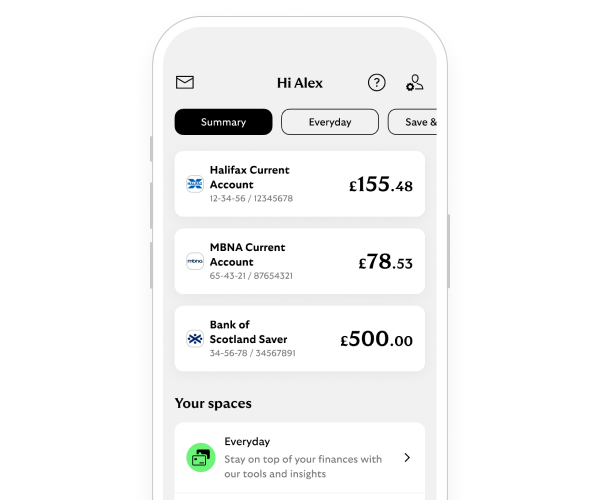

Open Banking lets you see all your accounts in one place. But you should always use your bank’s official app for any transactions. For your security, we transfer you to our secure website when you use Open Banking. Make sure the web address has the ‘s’ in ‘https://’ and that it ends in ‘lloydsbank-online.co.uk’.

We will never:

If you see any transactions you don’t recognise, contact us straightaway.

These claims may be protected by the Contingent Reimbursement Model code. Get in touch, we’ll continue to review these claims on a case-by-case basis.

From 7 October 2024, to protect you from fraud, Lloyds will follow a new set of rules for customer scam refunds.

Lloyds is a signatory of the voluntary CRM code. This is a set of standards designed to protect consumers from Authorised Push Payment (APP) scams. In these types of scams, fraudsters trick people into authorising payments to their accounts.

The CRM code doesn’t apply:

The PSR regulates the payment systems that the UK banks, building societies, and payment service providers operate.

When someone moves money electronically, they do this using a payment system. This includes contactless payments, money transfers, and your salary.

Our APP fraud data for 2023 is shown on the graphs at the bottom of our homepage. We show this information in line with PSR requirements, using the data that they collect from all major UK banks.

You might notice groups of brands in the graphs. Lloyds is part of a group with Halifax and Bank of Scotland, so this data is for all three brands combined.

You can read the full report at psr.org.uk/app-fraud-data