Go paper-free

Amend paper-free preferences for your statements and correspondence.

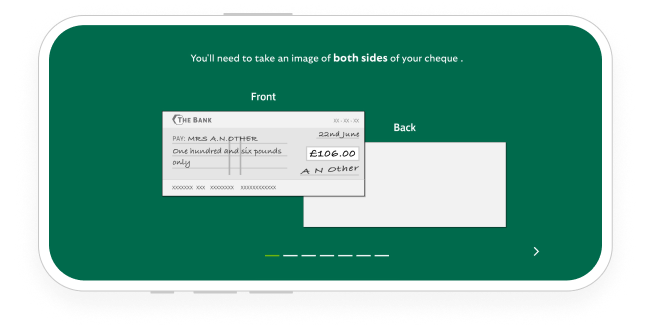

There are some types of cheque that you can't pay in with the app. The app will let you know if this happens.

If you don't use our app, you can call us. If you prefer to bank in person, there’s a range of services in your local area.

You can also pay in a cheque by post.

Need help?

If you're registered for online banking, the fastest way to get in touch is by messaging us securely online.

If you cannot use the mobile banking app, you can pay a cheque into your personal current account or savings account by post.

You can send your cheque by regular or tracked post. We recommend using tracked post for added security.

Place your cheque in a stamped envelope and send it to: LBG Processing, PO Box 13664, Harlow, CM20 9XF

You can expect the money to reach your account within 2 working days from when we receive the cheque.

If you posted a cheque to us more than 10 working days ago and haven’t seen the money in your account, contact us.

We need the following: